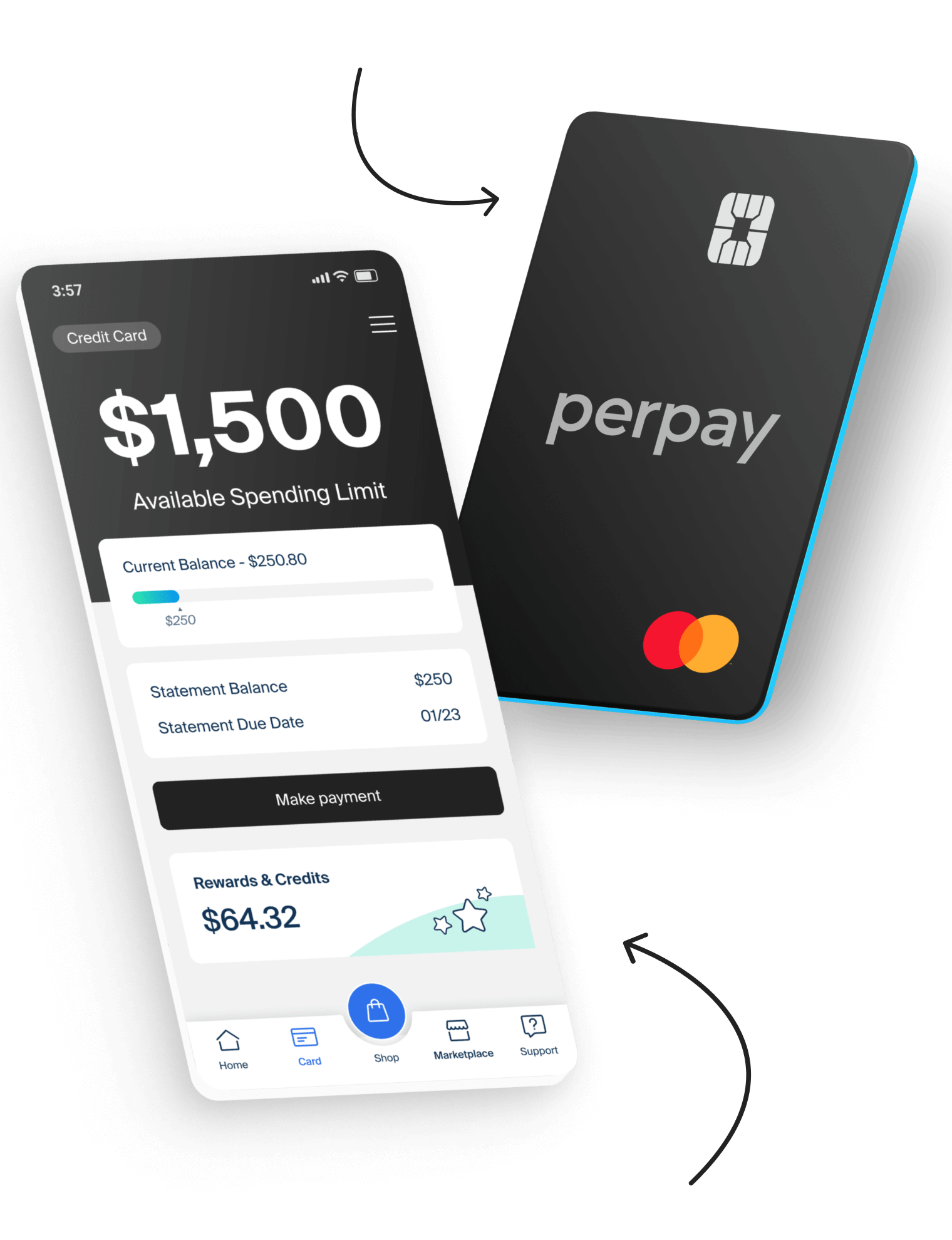

Perpay facilitates purchases through a payroll-deduction system. Users select an item from Perpay’s marketplace, and the total cost is divided into equal installments. These installments are automatically deducted from the user’s paycheck over a predetermined period, typically a year. Upon completion of the payments, the purchased item is shipped. This differs from traditional credit cards which involve revolving credit lines, interest charges, and credit score impact.

This system provides access to desired goods without requiring upfront payment or impacting credit scores. It offers a structured, budgeted approach to acquiring items, fostering responsible spending habits. Evolving from earlier layaway models, payroll-deduction purchasing offers a modernized, convenient alternative to traditional credit and financing options. It addresses the needs of consumers seeking accessible and predictable payment plans.

Understanding this purchasing model requires exploring its specific features, eligibility requirements, associated fees, and comparison with other financing methods. The following sections will delve into these crucial aspects, providing a complete picture of this unique financial tool.

1. Payroll Deduction

Payroll deduction is fundamental to Perpay’s operation, distinguishing it from traditional credit card systems. It forms the core of the payment process, directly impacting how users acquire goods and manage their finances. Examining its facets provides crucial insight into Perpay’s mechanics.

-

Automated Payments

Perpay automates payments through direct deductions from the user’s paycheck. This eliminates the need for manual payments and reduces the risk of missed deadlines. For example, a predetermined amount is deducted each pay period, ensuring consistent progress towards paying off the purchase. This automated system simplifies budgeting and promotes responsible financial management.

-

Fixed Payment Schedule

The payroll deduction system facilitates a fixed payment schedule. Users agree to a specific repayment period, typically one year, and the total cost is divided into equal installments. This predictability allows users to plan their finances effectively, knowing the exact amount deducted with each paycheck. This differs from credit cards where minimum payments can fluctuate based on the outstanding balance.

-

Employer Involvement

Perpay requires employer participation to facilitate payroll deductions. Users must link their Perpay account to their employer’s payroll system. This ensures payments are made directly from the user’s earnings. The employer acts as a facilitator in the payment process, deducting and remitting the agreed-upon installments to Perpay.

-

Budgeting and Financial Planning

The fixed, automated nature of payroll deductions allows for easier budgeting and financial planning. Users can anticipate the deductions and adjust their spending accordingly. This contrasts with credit card payments, which can vary and potentially disrupt budgeting efforts. The predictable deduction fosters responsible spending and helps users avoid accumulating debt.

These facets of payroll deduction demonstrate how Perpay offers a structured and transparent purchasing method. By integrating with an individual’s earnings, it streamlines payments, promotes responsible financial behavior, and provides an alternative to traditional credit-based systems.

2. Fixed Installments

Fixed installments represent a core component of Perpay’s functionality. Unlike revolving credit lines with variable minimum payments, Perpay divides the total purchase price into equal, predetermined installments. This structure provides predictability and transparency, allowing users to understand their financial obligations clearly. For instance, a $1,200 purchase divided into 12 monthly installments results in a fixed payment of $100 per month. This contrasts sharply with credit card payments, which can fluctuate based on interest rates, outstanding balances, and minimum payment requirements. The fixed installment structure simplifies budgeting and reduces the likelihood of unexpected financial strain.

The predictability of fixed installments facilitates responsible spending habits. Users know the exact amount due each pay period, eliminating the uncertainty associated with variable interest rates and fluctuating minimum payments. This clarity empowers individuals to manage their finances proactively and avoid accumulating debt. Furthermore, fixed installments promote financial discipline, as users commit to a consistent payment schedule. This structured approach fosters responsible financial behavior and aids in long-term financial planning. Consider a user purchasing a new appliance. Knowing the exact monthly payment for a defined period simplifies budgeting and integrates seamlessly into long-term financial goals.

In summary, fixed installments are integral to Perpay’s operational model. They provide predictability, transparency, and foster responsible spending habits. This contrasts with traditional credit card systems characterized by variable payments and interest charges. Understanding the role of fixed installments provides critical insight into Perpays value proposition and its appeal to individuals seeking a structured and controlled approach to purchasing.

3. No Interest Charges

A key differentiator of Perpay is the absence of interest charges. This feature significantly impacts how the system functions and contrasts sharply with traditional credit cards. Understanding the implications of “no interest charges” provides crucial insight into Perpay’s mechanics and its overall value proposition. Eliminating interest payments simplifies budgeting and reduces the total cost of purchases, making it an attractive alternative for consumers seeking transparent and predictable financing.

-

Predictable Costs

The absence of interest charges ensures predictable costs. Users pay only the original price of the item, divided into equal installments. This predictability simplifies budgeting and eliminates the uncertainty associated with fluctuating interest rates on credit card balances. For example, a $500 purchase remains $500 over the payment term, unlike credit cards where accruing interest can significantly inflate the final cost.

-

Simplified Budgeting

With no interest calculations, budgeting becomes straightforward. Users know the exact amount due each pay period, facilitating accurate financial planning. This simplifies personal finance management compared to credit cards, where interest calculations can complicate budgeting efforts. This predictable payment structure allows users to integrate purchases seamlessly into their existing financial plans.

-

Lower Total Cost

The absence of interest results in a lower total cost compared to using traditional credit cards, especially for individuals prone to carrying balances. This can translate to significant savings over time. For instance, purchasing a television through Perpay results in a final cost equivalent to its retail price, whereas financing the same television with a credit card might lead to a substantially higher overall cost due to accumulated interest.

-

Focus on Principal Repayment

Without interest charges, all payments directly reduce the principal balance. This accelerates the payoff process and ensures that each payment contributes directly to owning the purchased item. This differs from credit cards where a significant portion of initial payments often goes towards servicing interest charges. Perpay’s focus on principal repayment provides a more efficient path to ownership.

The “no interest charges” feature is fundamental to how Perpay works. It underscores its commitment to transparent pricing and predictable payments, distinguishing it from traditional credit card systems and providing a financially advantageous option for consumers. This feature contributes significantly to Perpay’s appeal, particularly for budget-conscious individuals seeking controlled and predictable purchasing methods.

4. Predetermined Purchase

Perpay’s operation centers around the concept of a predetermined purchase. This distinguishes it fundamentally from traditional credit cards, which offer open lines of credit for various purchases. Understanding this core principle is crucial to grasping how Perpay functions. The following facets explore the implications and mechanics of predetermined purchases within the Perpay system.

-

Restricted to Perpay Marketplace

Purchases through Perpay are restricted to items available within its marketplace. Unlike credit cards that can be used at virtually any merchant, Perpay users select goods from a curated catalog. This curated marketplace allows Perpay to manage inventory and logistics efficiently. While limiting purchase choices, it streamlines the process and aligns with Perpay’s focus on specific product categories.

-

Purchase Before Payment

While payment occurs over time, the specific item is chosen upfront. This differs from credit cards where purchases are made as needed, drawing from an available credit line. Selecting an item beforehand initiates the payment plan and dictates the installment amounts. This predetermined purchase structure is integral to Perpay’s budgeting and payment system.

-

No Open Credit Line

Perpay does not provide an open line of credit like a traditional credit card. Each purchase initiates a separate, fixed payment plan. Users cannot make impulsive purchases or accumulate revolving debt. This structure promotes responsible spending and avoids the potential pitfalls of open credit lines. It reinforces the disciplined approach to purchasing facilitated by Perpay.

-

Facilitates Budgeting and Planning

The predetermined purchase nature allows for precise budgeting. Knowing the total cost and payment schedule upfront simplifies financial planning. This contrasts with credit cards where spending can vary, leading to unpredictable balances and interest charges. Perpay’s structure allows users to allocate funds effectively and avoid unexpected financial burdens. This aligns with Perpay’s overall goal of promoting responsible financial behavior.

The predetermined purchase aspect of Perpay is integral to its operation. It defines the user experience, shapes the payment structure, and contributes to Perpay’s unique position within the financial landscape. By focusing on specific items within a controlled marketplace, Perpay fosters a structured approach to purchasing, reinforcing its commitment to responsible financial habits and predictable payment schedules. This contrasts with the flexible, but potentially less controlled, nature of traditional credit cards, highlighting Perpay as a distinct alternative for those seeking structured purchasing power.

5. No Credit Check

Perpay’s “no credit check” policy is a defining feature, directly influencing its accessibility and overall functionality. This aspect is crucial to understanding how Perpay operates and distinguishes it from traditional credit card applications. Examining the implications of this policy provides valuable insight into Perpay’s target audience and its unique approach to consumer financing. It represents a significant departure from traditional lending practices and contributes to Perpay’s distinct position within the financial landscape.

-

Increased Accessibility

The absence of a credit check expands access to Perpay’s services. Individuals with limited or no credit history, who might be denied traditional credit cards, can utilize Perpay. This inclusivity broadens the potential user base and addresses a segment of the population often excluded from conventional financing options. For example, someone starting their career or rebuilding their credit can acquire necessary goods through Perpay without credit history acting as a barrier.

-

Focus on Affordability

Perpay prioritizes affordability by assessing purchasing power based on current income rather than past credit performance. The payroll deduction system ensures payments align with earnings, mitigating the risk of overextension. This focus on affordability distinguishes Perpay from credit card systems that may approve individuals for credit lines exceeding their repayment capacity. This emphasis aligns with Perpay’s commitment to responsible spending and financial well-being.

-

Simplified Application Process

Eliminating the credit check streamlines the application process. Users can quickly onboard and access Perpay’s services without lengthy credit evaluations. This efficiency benefits both the user and Perpay, reducing administrative overhead and facilitating faster access to desired goods. This streamlined approach contrasts with traditional credit card applications, which often involve extensive credit inquiries and approval processes.

-

Promoting Financial Inclusion

By disregarding credit scores, Perpay promotes financial inclusion, offering purchasing power to individuals who might be marginalized by traditional credit systems. This inclusivity aligns with Perpay’s mission to provide accessible financial tools and empower individuals regardless of their credit history. This approach contributes to a more equitable financial landscape by offering opportunities to those often excluded from traditional lending practices.

The “no credit check” policy is integral to how Perpay functions. It directly impacts accessibility, affordability, and the overall user experience. This approach distinguishes Perpay from traditional credit card models and reinforces its commitment to financial inclusion and responsible spending. It offers a viable alternative for individuals seeking a structured purchasing method without the constraints of credit score requirements, contributing to its unique position within the consumer finance market.

6. Item Shipped After Payment

The “item shipped after payment” principle is fundamental to understanding Perpay’s operation and how it differentiates itself from traditional credit cards. This aspect directly influences the user experience and shapes the overall financial dynamics of the purchasing process. It reflects Perpay’s unique approach to consumer finance and its emphasis on responsible spending. The following breakdown explores the multifaceted nature of this principle and its implications.

-

Delayed Gratification

Shipping after full payment instills a practice of delayed gratification. Users must complete the payment plan before receiving the item, encouraging thoughtful purchasing decisions and discouraging impulsive spending. This differs significantly from credit cards, which provide immediate access to goods, potentially leading to overspending and debt accumulation. This delayed gratification model reinforces Perpay’s focus on responsible financial behavior.

-

Mitigating Financial Risk

By shipping only after full payment, Perpay mitigates financial risk for both the company and the consumer. The company avoids losses associated with non-payment, and consumers are protected from accumulating debt for items they haven’t yet received. This contrasts with credit card systems where users can incur debt for purchases they may later regret or struggle to afford. This risk mitigation strategy is central to Perpay’s operational model.

-

Guaranteed Ownership

Upon receiving the item, users have full ownership without any outstanding debt. This provides a sense of financial security and avoids the prolonged payment periods and accruing interest common with credit cards. This guaranteed ownership upon receipt reinforces the value proposition of Perpay, providing a clear and transparent path to acquiring goods. Users achieve complete ownership without the burden of ongoing debt.

-

Budgeting and Financial Planning

The “item shipped after payment” structure encourages disciplined budgeting. Users must plan and allocate funds over the payment period, fostering responsible financial habits. Knowing that an item will arrive only after full payment incentivizes disciplined saving and spending. This structured approach contrasts with the open-ended nature of credit card spending, which can make budgeting more challenging. Perpay’s model encourages proactive financial management.

In essence, “item shipped after payment” is a cornerstone of how Perpay works. It reinforces responsible spending, mitigates financial risk, and ensures guaranteed ownership upon delivery. This approach distinguishes Perpay from traditional credit card systems and positions it as a unique and viable alternative for consumers seeking a structured, controlled, and financially sound approach to acquiring goods. It promotes a more deliberate and financially responsible purchasing behavior, aligning with Perpay’s core values and distinguishing its unique position within the consumer finance market.

Frequently Asked Questions

This section addresses common inquiries regarding Perpay’s functionality and its distinction from traditional credit cards. Clarity on these points is crucial for a comprehensive understanding of this unique purchasing method.

Question 1: How does Perpay differ from a traditional credit card?

Perpay uses payroll deductions to purchase items from its marketplace. No credit check is required, and no interest accrues. Items ship after full payment. Traditional credit cards offer a revolving line of credit for purchases from various merchants, involve credit checks and interest charges, and provide immediate access to purchased items.

Question 2: Does using Perpay affect credit scores?

Perpay does not report to credit bureaus. Therefore, activity within the platform neither builds nor harms credit scores. This differs from traditional credit cards, which typically report payment history and can impact credit scores positively or negatively.

Question 3: What happens if employment changes during a Perpay payment plan?

Users must notify Perpay immediately upon any employment change. Alternative payment arrangements will be necessary to fulfill the outstanding balance and receive the purchased item. This ensures the commitment to the purchase remains intact despite employment changes. Specific details regarding alternative arrangements can be discussed directly with Perpay.

Question 4: Can any item be purchased through Perpay?

Purchases are limited to items available within the Perpay marketplace. This curated selection differs from the open purchasing options provided by traditional credit cards. The Perpay marketplace focuses on specific product categories, providing a streamlined shopping experience.

Question 5: Are there any fees associated with using Perpay?

While Perpay does not charge interest, specific fees may apply depending on individual circumstances or specific purchase agreements. It’s essential to review the terms and conditions associated with each purchase to understand any applicable fees. Transparency regarding fees is crucial for informed financial decisions.

Question 6: How does Perpay ensure payment security?

Perpay employs robust security measures to protect user data and financial information. Details regarding specific security protocols can be found within Perpay’s privacy policy. Prioritizing data security is paramount in maintaining user trust and ensuring the integrity of the platform.

Understanding these key distinctions between Perpay and traditional credit cards is crucial for informed financial decision-making. Perpay offers a structured alternative to traditional credit, focusing on responsible spending and financial accessibility.

The following section will explore real-world examples and user testimonials to illustrate the practical applications and benefits of the Perpay system.

Tips for Utilizing Perpay Effectively

Maximizing the benefits of Perpay requires a clear understanding of its mechanics and strategic planning. The following tips provide practical guidance for navigating the platform and aligning it with individual financial goals.

Tip 1: Budget Carefully

Before committing to a purchase, thoroughly evaluate personal finances. Ensure the fixed installments align comfortably within the existing budget. Avoid overextending financial resources by committing to payments that strain monthly cash flow.

Tip 2: Explore the Marketplace

Familiarize yourself with Perpay’s marketplace offerings. Understand the available product categories and specific items before initiating a purchase. This allows for informed decisions and ensures alignment with individual needs and preferences.

Tip 3: Plan for Larger Purchases

For significant purchases, consider the long-term implications of the payment plan. Ensure the fixed deductions remain manageable over the entire repayment period, even considering potential changes in financial circumstances.

Tip 4: Understand Payment Schedules

Clarify the specific payment schedule and deduction frequency. Confirm alignment with personal pay cycles to avoid any potential conflicts or disruptions in cash flow management. Knowledge of the payment schedule allows for proactive financial planning.

Tip 5: Communicate with Perpay

If financial hardship arises or employment changes occur, communicate promptly with Perpay. Explore available options and alternative payment arrangements to mitigate potential disruptions to the payment plan and ensure continued access to the purchased item.

Tip 6: Review Terms and Conditions

Prior to finalizing any purchase, carefully review the associated terms and conditions. Understand all applicable fees and payment stipulations to avoid unexpected charges and ensure complete transparency.

Tip 7: Prioritize Essential Purchases

Utilize Perpay for essential purchases, prioritizing needs over wants. This ensures responsible utilization of the platform and aligns with the core principles of structured spending and financial planning.

By adhering to these guidelines, individuals can effectively utilize Perpay’s unique purchasing model to acquire necessary goods while maintaining financial stability. Strategic planning and responsible budgeting are crucial for maximizing the benefits of this platform.

The following conclusion summarizes the key advantages of Perpay and its role as an alternative to traditional credit card systems.

Conclusion

Examination of Perpay reveals a purchasing model distinct from traditional credit cards. Its core mechanics involve payroll deduction, fixed installments, and the absence of interest charges. Items are shipped after payment completion, and no credit check is required. This system offers a structured approach to acquiring goods, promoting responsible spending habits and financial accessibility. Perpay provides an alternative for individuals seeking predictable payments and controlled purchasing power, particularly those who may not qualify for traditional credit or prefer to avoid interest charges and revolving debt. Its unique framework addresses the need for accessible and transparent financing options within the modern consumer landscape.

Perpay represents an evolving landscape of consumer finance, offering a distinct approach to purchasing. Further exploration of alternative financial tools empowers informed decision-making and promotes financial well-being. Understanding the mechanics of platforms like Perpay allows individuals to navigate the complexities of personal finance effectively and make choices aligned with individual circumstances and financial goals. Continued evolution within the financial technology sector promises further innovation and diversified options for consumers seeking accessible and responsible purchasing power.